Stocks To Buy! February 5th-9th

Weekly Newsletter to keep you prepared for the markets!

Earnings Calendar

Got a lot of earnings this week that will effect the overall market.

QQQ - Consolidation

QQQ 0.00%↑ trading sideways between $416 & $429. If the market pulls back I want to grab calls at $416. $416 is a great support to play the bounce off the support. We are bullish above $429 which is the breakout level. The overall market trend is to the upside.

Rivian Automotive - Long Shares

RIVN 0.00%↑ got 100 shares at $15.55. RIVN 0.00%↑ is currently sitting at a critical level of support.

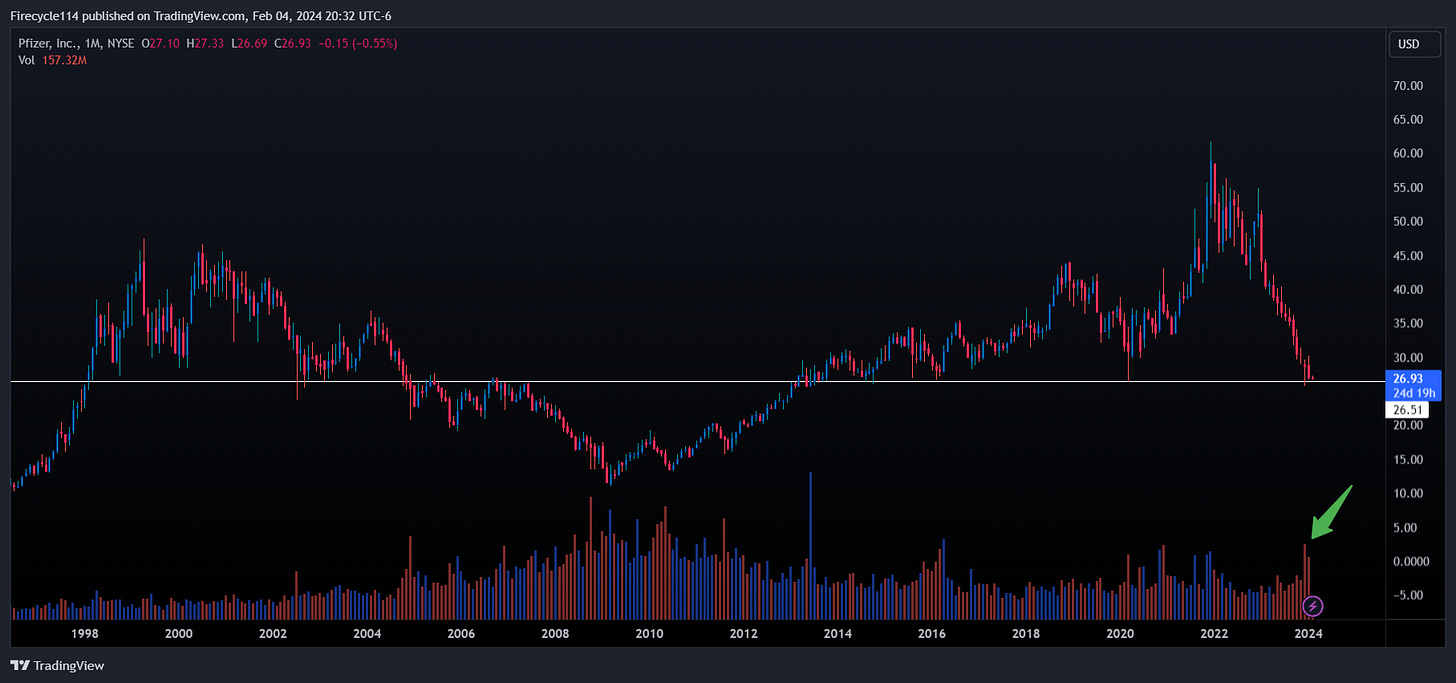

Pfizer - Long Term Shares

PFE 0.00%↑ is sitting at a incredible level of support. $26.51 is a support that is being held since 1998 The only time we broke this level of support was during the 2008 financial crisis.

Apple - 1 Month Out Call Options

I got AAPL 0.00%↑ 180c 3/1 @ 5.90. My price target for Apple is $196 by March 1st.

Shopify - Day Trade

SHOP 0.00%↑ above $84 for a day trade. The price action for Shopify is absolutely incredible. We have been trading sideways for a month now between $77 & $83. We got earnings next week which is a catalyst for a potential earnings run up.

Above $84 I want to grab weekly calls. Right at market open on the 5 minute timeframe is the confirmation I am looking at.

ABNB - Long Term

ABNB 0.00%↑ ascending triangle formation on the weekly timeframe, Airbnb has been trading sideways consolidating for more than a year now. Earnings are coming up and I want to grab shares for a 3-6 month swing play.