Stocks To Buy This August! 2025

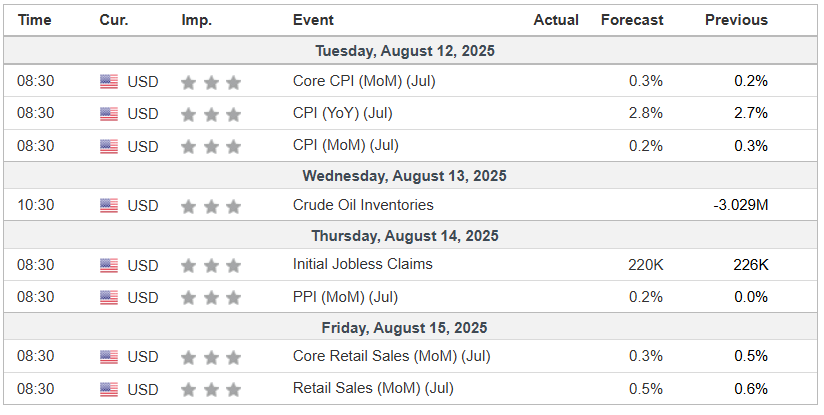

Here’s this month's stock watchlist with key buy zones and setups. With CPI inflation numbers coming in this week and potential market volatility ahead, here’s where I’m looking to position:

Inflation Numbers

CPI & Inflation: This week’s CPI report, released one hour before market open, will be key in shaping Fed policy expectations. With Jerome Powell holding off on rate cuts due to Trump tariffs and potential inflation pressures, the data could spark significant volatility. A softer CPI may boost rate-cut hopes and lift markets, while a hotter print could trigger a pullback as investors price in “higher for longer” rates.

1. Tesla TSLA 0.00%↑

Setup: Breaking out of consolidation with a cup-and-handle formation on the daily chart.

Buy Zone: $286 support – ideal for picking up weekly calls if we dip here.

Upside Targets: $355 and $371.

Note: Patience is key — waiting for the market or TSLA to pull back before entering.

2. C3ai AI 0.00%↑

Setup: Strong technical structure similar to Palantir and Coinbase early breakouts.

Current Price: ~$22.

Buy Zone: $20 — prime entry for long-term shares.

Potential: Possible multi-year 10x opportunity given AI sector growth. Waiting for post-earnings clarity before entering.

3. Gartner IT 0.00%↑

Setup: Recently hammered after earnings, now at strong support with extremely oversold RSI.

Buy Zone: Current support level; stop-loss just below it.

Potential: Double-bottom reversal setup.

4. United Parcel Service UPS 0.00%↑

Setup: Blue-chip stock at 10-year lows.

Buy Zone: Current level — aligned with 2013 support.

Potential: Attractive for long-term value investors; cheap entry into a stable dividend stock.

5. UnitedHealthCare UNH 0.00%↑

Setup: Beaten down heavily from DOJ investigations and earnings misses.

Buy Zone: $209 support — potential bounce area for weekly calls or quick trades.

Trade Idea: Day trade calls on support for a possible 100% short-term gain.

6. Snapchat SNAP 0.00%↑

Setup: Oversold at major historical support after earnings drop.

Current Price: ~$7.

Buy Zone: Right at current levels for long-term swing.

Potential: Possible 66% upside if it recovers from here.