Weekly Watchlist 11/28-12/2

Stocks with nice setups to watch for this week. These are short-term option plays. I go over the stocks that I am watching, the economic calendar and the overall market sentiment and what to expect!

P.S if for some reason you are seeing this email in your promotions inbox make sure you move it to the primary mailbox.

Economic Calendar

This week we do have a lot of uncertainty with different catalysts like Consumer Confidence, Fed Chair Powell Speaking & Unemployment Rate. Please be aware of these catalysts because the market reacts off of the news and results. Understand the risk of swinging overnight through these catalysts. For example I had CAT 0.00%↑ and BAC 0.00%↑ puts 2 weeks ago and the chart was screaming bearish. I swung my position into a Inflation Catalyst and the market pumped due to that news. Even though the technical analysis is screaming bullish or bearish please be aware of these catalysts that cause volatility. Manage your risk and probabilities!

Market Sentiment / Overview of Trend

Technical analysis is screaming bullish for the overall markets the SPY 0.00%↑ andQQQ 0.00%↑. The price target for the SPY is $410 this week. Major level of resistance. I am bullish until we hit $410 and that is where I will be selling off my positions and just staying on the sidelines. The chart looks great with gaps to the upside for both $SPY & $QQQ.

1. SPY 0.00%↑ S&P 500 ETF

This is my main play that I am already in. I made a whole article and a whole YouTube video for this play! Make sure to check the article and video out!

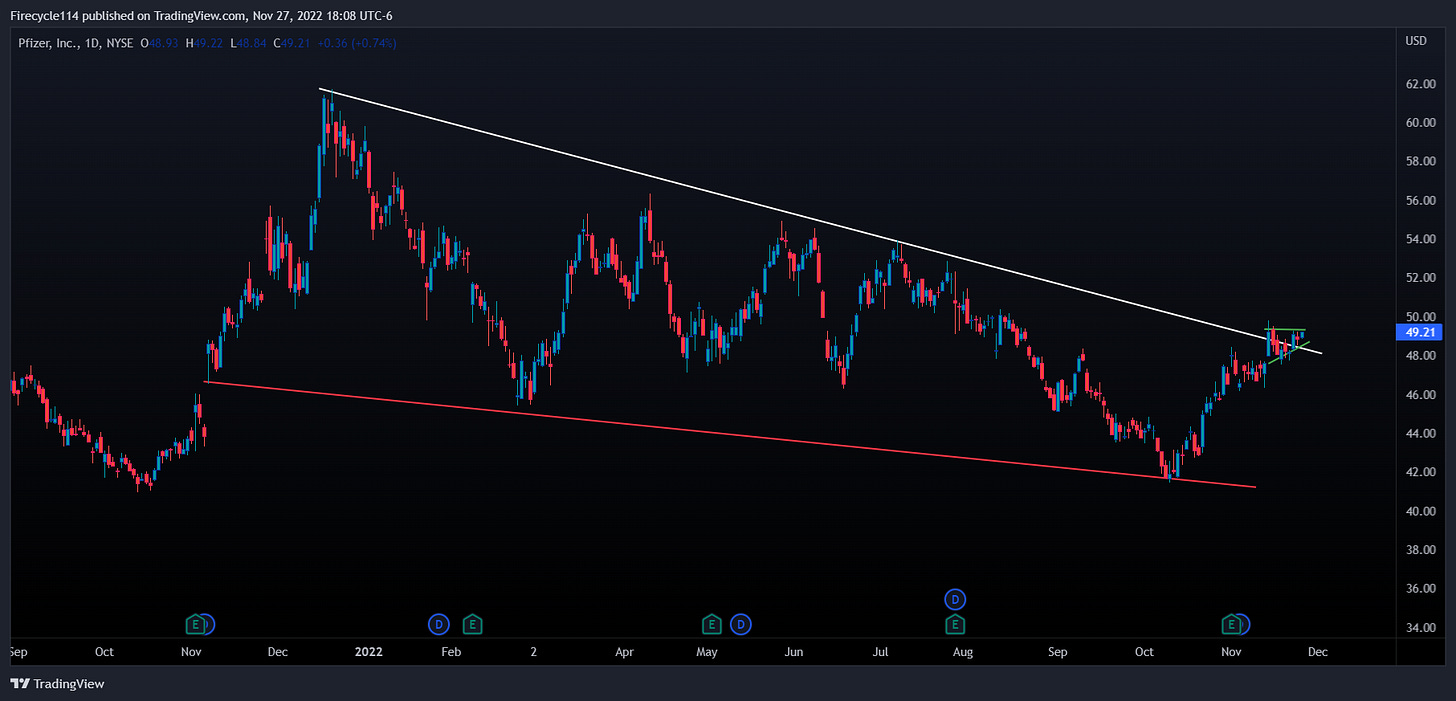

2. PFE 0.00%↑ Pfizer, Inc

Pfizer on the daily timeframe is breaking the downtrend and has in fact closed above a major level of resistance even on the weekly timeframe. We are breaking a major downtrend on the daily and weekly timeframe.

Pfizer on the daily timeframe zoomed in looks a lot more interesting. We have a ascending triangle formation with a support and resistance + a wick acting as our entry, stop loss and price target. Looking to play calls at open, price target $50+ for a day trade.

3. UNH 0.00%↑ United Health Group

This is the overall healthcare ETF and tracks companies in the healthcare sector, biotech and vaccines. Just watching this as the overall healthcare sector looks bullish, going with out vaccine play PFE 0.00%↑.

Taking a look at a bigger picture we can see the overall trend and how it is consolidating right now for a move to the upside potentially.

4. COIN 0.00%↑ Coinbase Global, Inc

We have talked about COIN 0.00%↑ in another article . It is sitting around the level of support which is a critical level of support. We can play calls here for a swing and have a stop loss below 44 on the weekly candle close. Or we can play puts if it starts breaking the 44 level.