Weekly Watchlist 12/27-13/30

Will we get the anticipated Santa Claus Rally for the end of the year or new yearly lows or just sideways movement? Stocks with great setups that I am watching this week. Shares & Swing Option Plays.

P.S if you are seeing this email in your promotions inbox make sure you move it to your primary inbox!

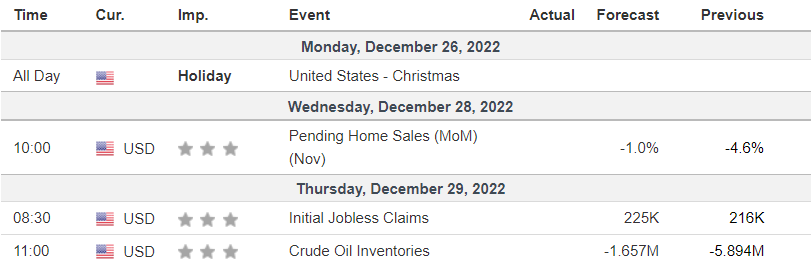

Economic Calendar

This week we don’t have any major catalyst that I am watching this week but we are coming in from a Christmas Holiday break. Typically around holidays the volume for stocks are lower as more investors and traders are spending time with family or are on vacation and don’t want to trade that week. That could mean less movement potential for stocks or us just trading sideways in the market. Especially with New Years coming right around the corner. From my past 3 years of experience in the market we typically get a very dry movement. Keep this in mind when it comes to breakouts.

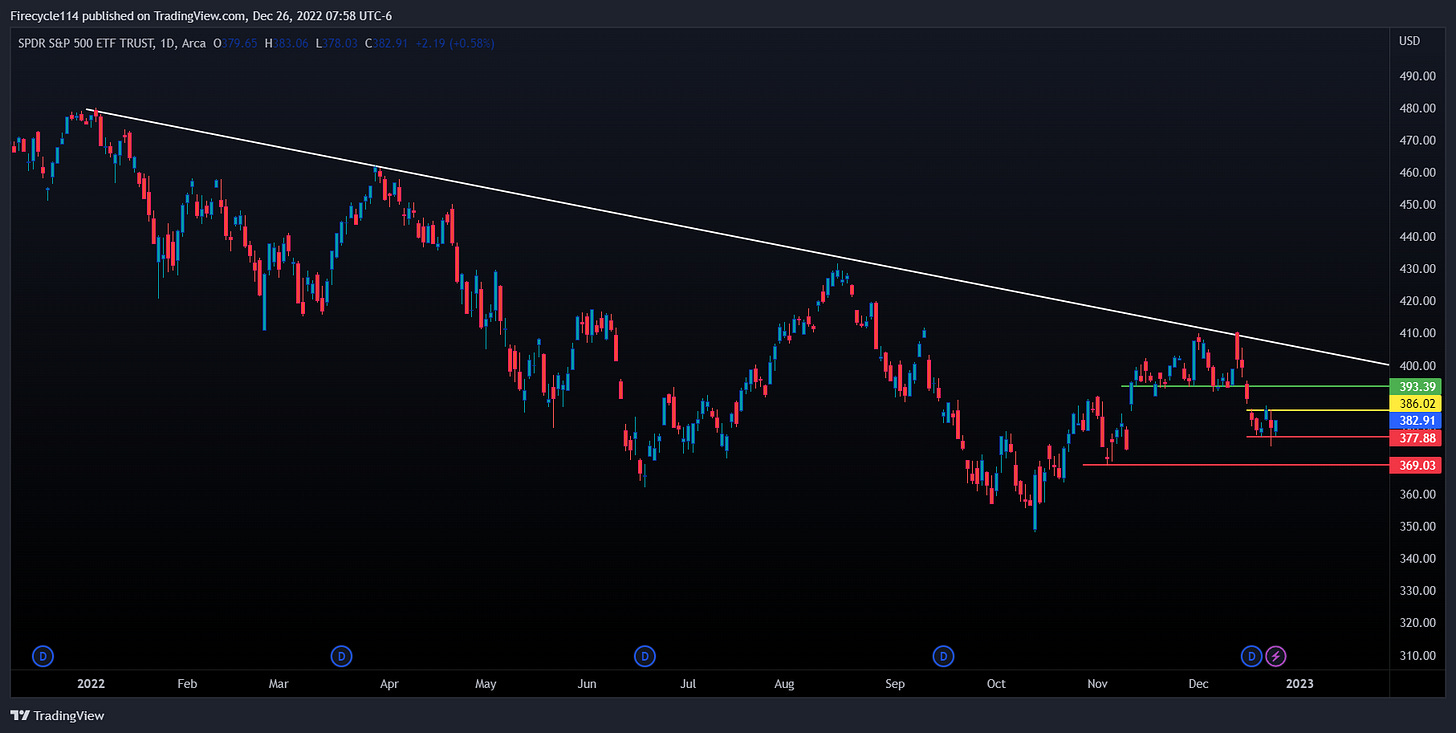

Market Trend & SNP 500 Level

The overall trend is bearish as seen on the daily/weekly/monthly timeframe. With macro economic players like recession, interest rates & economic pressure the stock market has been on a steady decline for the past year. Looking closer at the daily timeframe it is a falling knife.

Support: 377.88, 369

Resistance: 386, 393

Exxon Mobil Corporation 1D

Exxon Mobile is my A+ setup for this week. I’m taking a look at calls right at market open to play the breakout of the Ascending Triangle. Oil stocks are looking strong this week.

🟡Above 108.67 Bullish (Yellow Line)

🟢Price Target 111.91 & 114.41

🔴Stop Loss 105.79 (Red Line)

UnitedHealth Group Incorporated

UNH 0.00%↑ This is a more longer swing play. Holding for multiple days and weeks and maybe months. The setup is on a bigger timeframe looking better on the weekly & monthly. This is also a great shares plays which I am looking to play. I want to play shares since I love the risk to reward and no stress of theta and time decay.

🟡Entry for shares would be right around the current area @ 531.32 or if it drops to the support @ 524

🔴Stop Loss: Close Below 517.13 on the weekly timeframe.

🟢Price Target: Break through all time highs 554, 585.

Meta Platforms, Inc 1D

This is a neutral option swing/day trade that I am looking at. Bullish above green line or bearish below red line with given price targets (yellow lines).

I go more in-depth on my YouTube video which I will post tonight. Subscribe with notifications!