Weekly Watchlist 1/9-1/13

Market Sentiment & Stocks I am watching this week! This week is going to be intense and unpredictable with Inflation Data & Fed Chair Powell speaking.

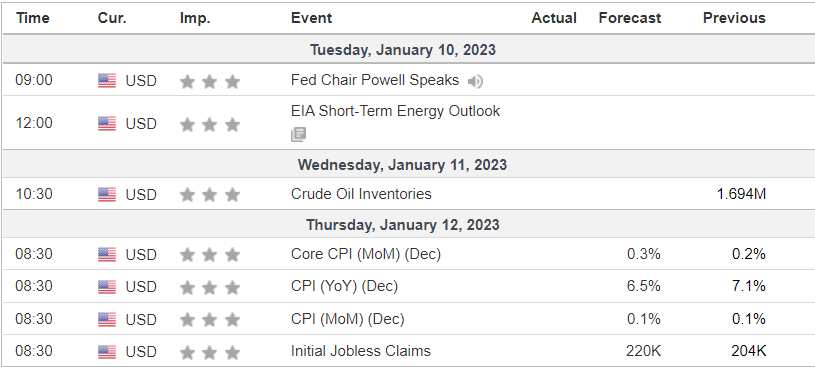

Economic Calendar

Fed Chair Powell speaking on January 10th & Inflation Data on Thursday are 2 major catalysts. These catalysts make me not trade this week because these can go either way and the news comes out at pre market.

S&P 500

After breaking out of the consolidation phase last week on Friday the resistance we broke has become the support.

Bullish Scenario: Price Target 393 since we broke the 386 level last week. The bulls need to hold 386 to be bullish. Calls at 386 is a great area.

Bearish Scenario: Below 386 PT 377.

Walt Disney Company DIS 0.00%↑

DIS 0.00%↑ Daily & Weekly falling wedge, closed above the resistance on the daily. Continuation play with stop loss below $92, PT 97.20 & 99.89.

Amazon.com, Inc 1D

AMZN 0.00%↑ Daily Falling Wedge. Above 87 PT 90 & 96. This can be a really nice play especially if the whole market runs.

Overall

One thing to keep in mind with these plays is that we have uncertain catalysts this week. And swinging over these catalysts is a coin flip. If you are trading please understand the risk & probability of these catalysts.